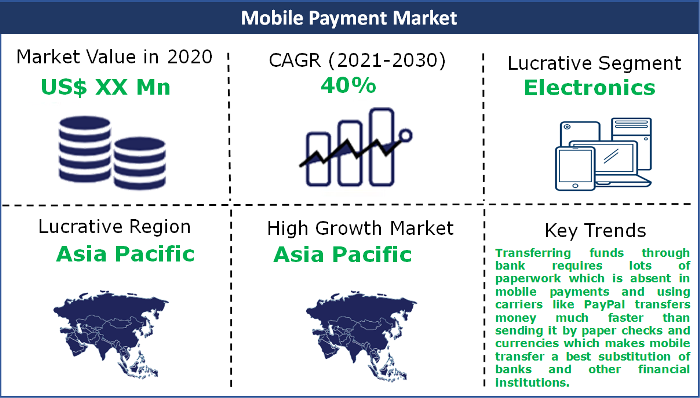

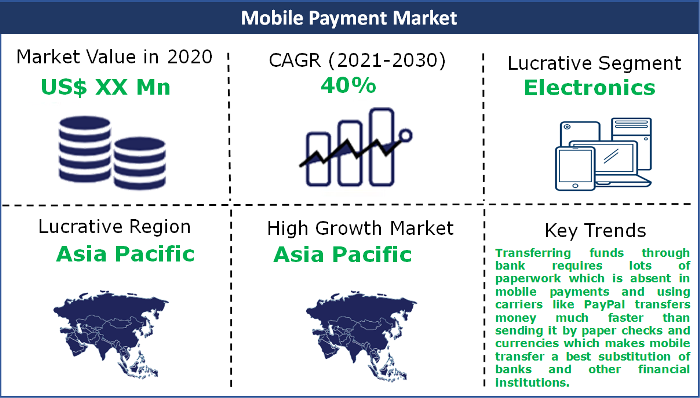

2021-2030 Analysis and Review Mobile Payment Market

Mobile Payment Market By Application - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast, 2021 – 2030

Mobile payments offer variety of benefits, it improves convenience for customers, reduce collection process and collection errors. Consumers are beginning to see the advantage of mobile payments rather than carrying clunky coins and cash even plastic money and want to go wallet free so the mobile payment companies are being stressed to formulate new, more aggressive and dynamic strategies to sustain and for growth in quickly changing payment market.The mobile payment market is expected to grow at a CAGR of 40% during the forecast period of 2022-2030.The emergence of branchless and mobile banking solutions over the last decade drastically altered the economics of banking the unbanked and provided opportunities within the developing markets. Setting a bank branch at remote place requires lots of financial as well as human capital which enables mobile payment provider to enter these areas and grab the market. Transferring funds through bank requires lots of paperwork which is absent in mobile payments and using carriers like PayPal transfers money much faster than sending it by paper checks and currencies which makes mobile transfer a best substitution of banks and other financial institutions.

The Pandemic Has Compelledthe Adoption of Mobile Payment Exponentially

The market is driven by various factors which include factors such as the rigidity of banks and other inefficiencies in their services, exponential growth of mobile phone users in the world, increasing share of smart phone in the mobile phone market, micropayments, transfers involving more than one currency, growth of e-commerce and its cost effectiveness, etc. Loyalty programs and coupons/ discounts are big motivators which are usually accessed where mobile payments are concerned.The impact of covid 19, has significantly driven the mobile payment market due to exponential transition rate from conventional payment to contact less and remote payment platform.

Increasing Infrastructural Platforms Leading to Technological Developments

Significant growth in the internet penetration across the globe and the growing number of smart phones are two major drivers for the mobile payment market. Also technological developments such as NFC technology for contactless payment and new chip card technology are driving the market. The growth of mobile payments and instant transactions are also driving the need to set up a real-time payment platform for the underlying infrastructure which consist of financial ecosystem (issuing bank, payment networks, acquiring bank), mobile ecosystem (NFC chipmakers, Mobile carriers, Handset OEMs) and retail ecosystem (POS providers and merchants).

P2P Dominates in terms of Market Revenues

P2P transfers continue to dominate the market in terms of revenue with over 70% share in 2022 and is expected to grow at a CAGR of 38.7% during the forecast period 2022-2030. Mobile P2P transfer is sending/ receiving money domestically or internationally over a mobile phone. Mobile P2P transfer service works on SMS based model where money is transferred via SMS. Mobile P2P is dominant player in African and Asian countries such as Kenya, Tanzania, Rwanda, Philippines and Vietnam etc. Prominent mobile P2P players are Vodafone M-Pesa, Airtel Money and GCash.Online technology that allow to transfer fund of customer from bank account or credit card to other account through internet or mobile phone is known as P2P (Person-to-Person) payment.

Closed Loop Payments Promise Opportunities During the Forecast Period

Closed loop payments is expected to grow at the fastest rate 72.8% during the forecast period, 2022-2030. Closed loop payments are a type of mobile payments when companies create their own mobile payment system which can be used only for making transactions at its store. Closed loop mobile payment solutions enable customers to manage their gift card or payment account via their mobile devices. Customers can check their balances, add money, and pay using a mobile application rather than a physical card. In a common way, closed loop cellular payments are those that enable purchasers to load money into a spending account that's linked to a fee device – for instance, a reward card for a particular enterprise.Closed loop cell cost options enable buyers to control their present card or payment account by way of their mobile devices. Consumers can check their balances, add money, and pay making use of a cellular application instead than a card. Closed loop cellular payments systems can advantage each consumer and merchants alike, which is why many companies have no longer only opted to enforce them, but have also visible them succeed.

Partnerships is the Key Strategy Among the Top Market Players

Partnerships are key strategy of mobile payment companies as many players cater to a particular geography. To attain geographical expansion and to compete with key players of mobile payment system, companies are expanding their presence by forming partnering with other companies of electronic payment system. Partnership enables the market participants to enhance market shares and remain relevant and capture local market with a regional player. Key players in the market include American express company, Apple Inc., Google, LLC, JPMorgan Chase & Co, Mastercard, One97 Communications Limited, PayPal Holdings, Inc., PayU, Samsung, Visa Inc and others.

Historical & Forecast Period

This research report presents the analysis of each segment from 2020 to 2030 considering 2021 as the base year for the research. Compounded annual growth rate (CAGR) for each respective segment are calculated for the forecast period from 2022 to 2030.

Report Methodology

Market revenues and CAGR were derived from primary and secondary research. Both quantitative and qualitative trends were considered for extrapolation of market revenues. the derived market estimates were further validated from top down, bottom strategies and primary research. the scope of the market is limited to the following segments of product categories and region.

By Application (2020-2030; US$ Mn)

By Region (2020-2030; US$ Mn)

Global Impact of Covid-19 Segment (2020-2021; US$ Mn)

Key questions answered in this report

| $4,600 | |

| $6,600 | |

| $13,200 |

| Request customization |

| Get market alerts |

| Ask for regional data |

| Ask for country-specific data |